Introduction Ideally, we have managed our finances so that we don't often need to save $3,000 in 6...

How to Save More Money Each Month

Is money stress knocking at your door? You are not alone. According to NerdWallet, the average US household is carrying $7,919 in credit card debt, $29,251 in auto loans, and $59,149 in student loans all adding to an average mortgage balance of $227,188. With all those monthly responsibilities clawing at your bank account it is no wonder many Americans are wondering how to save more money each month. Lucky for you we have solid and time-tested advice that can help. Let's dig in.

How to Start Saving More Money Each Month

Are you using a zero-based budget? Are you sticking to it? The first step in learning to save more money each month is to know where your current dollars are going. Once you know where each dollar is going it is much easier to redirect them to your savings account. Trying to control money without a zero-based budget is a bit like trying to grasp the wind. It just doesn't work. So if you want to save more money each month you need to begin with a budget. Learn how to make and stick to a budget here.

Once you have a budget in place and you are sticking to it there are several ways to begin saving more.

Identify Your Variable Expenses First

Variable expenses are the places you spend money every month that have some flexibility and they are the easiest and fastest way to have an impact on your monthly savings. Your grocery budget is a good example. Your clothing budget would be another. However, your mortgage would not be a variable expense since the payment is probably the same every month. We call expenses like that "fixed expenses".

When you have a zero-based budget in place you can pretty easily identify your variable expenses and begin to look for ways to save. Here are some examples:

- Food - In nearly every household in America, the quickest way to start saving more money every month is in the food category. Most families don't realize how much they spend on groceries, much less on restaurants. Just staying out of restaurants for one month according to the Bureau of Labor & Statistics will add $300 back to your bottom line. Of course, you'll need to buy groceries to make up for the restaurant meals you gave up but since the average restaurant meal is about 4X the cost of eating at home you'll still realize more than $200 saved every month. Not bad for a little self-discipline.

- Subscriptions - Give yourself a subscription audit. When you have a budget and you are tracking every dollar earned and spent you should be able to quickly identify unused subscriptions that are wasting your money. Our family just completed a subscription audit and are now saving an additional $25 per month and are not missing a thing. We canceled and rearranged some services and are happier now than we were before.

- Discretionary Spending - Double shot mocha late half calf no cream anyone? Discretionary spending is all those things you do almost every day that may not even realize. But they add up. Look, if you want to save more money every month it takes some honest looks in the mirror and some self-discipline. Anything you spend in a month that isn't necessary to keep a roof over your head, groceries in your stomach or transportation available for work and school is basically discretionary. Look for all discretionary spending decisions like coffee, excess clothing, vacations, and more, and begin making cuts to the budget. You will save a lot more money each month.

- Utilities - Yes some utilities are variable. Is your electric bill the same in the summer and winter and spring? What about your water bill? To save more money every month you can work on using less electricity and water. Turn lights off in rooms not being used, combine loads of laundry, or take shorter showers. All of these things can help save money each month.

- Identify your other variable budget expenses and begin looking for ways to trim expenses. How about carpooling once a week to save money on gas, swapping babysitting chores with a friend for nights out, or saving money on your groceries without coupons? There are a lot of ways to save more money each month however it begins with a budget and taking the time to plan your budget accordingly.

.png?width=1200&length=1200&name=How%20to%20pay%20for%20college%20without%20student%20loans%20(8).png)

When you have a zero-based budget in place that you are actually using you can quickly identify variable expenses and begin making cuts. It is rarely a single change that helps you achieve financial goals, rather it is the combination of a lot of small decisions over time that get you there. Remember, these are not necessarily the easiest ways to save more money each month but they are the most effective. When it comes to money, shortcuts only leave you with more trouble and headaches. Making your money behave is the best way to save and build the future you want. "Children do what feels good. Adults devise a plan and follow it."

Next, Identify Your Fixed Expenses

Fixed expenses are places in your budget that are the same price every month. Your car insurance, the cable bill, the internet bill, and even the cell phone bill are good examples of fixed expenses for many families. They are also places you can save more money each month but the fixed expenses usually take a little more planning and effort to change. However, the effort can result in big savings.

- Cell Phones - At one time our family cell phone bill was close to $300 per month with one of the big brands with fancy commercials. Once our contract was up, I turned my attention to ways to save money and found that a month-to-month carrier was only $100 per month for a similar service and even came with 4 new phones (no-contract). No, they were not the best or latest phones but we survived the change and to this day we pay cash for less expensive phones when we need one and our phone bill for 5 lines of unlimited data is still only $125 per month. Trust me. With a little planning ahead and you can save an easy $150 or more per month on cell phone service. And that includes buying the occasional 2nd generation phone when needed.

- Cable TV & Internet - Companies are always jostling for pole position to earn your business and with that comes tough price competition. At one time, you had to pay for cell phone minutes and now they are unlimited. That happened because a cell phone provider decided to add more value to earn your business. So it pays about once per year to check in on the market for cable tv, streaming services, and internet packages. While you are busy living your life these companies are working daily to out-compete each other and if you keep an eye on the market, you can be the winner. Stay aware and price compare about once per year.

- Insurance - Most households carry several different insurances to protect their home, automobile, and life. Again, things change and markets change so be sure to get rate quotes about once per year. Often times new carriers enter the market and risk assessments can change. If you stay aware you can lower your premiums by a reasonable amount.

Don't Worry About Keeping Up with Your Neighbors

They are broke anyway. Look, you can do well with money if you make wise decisions using a budget and learn how to use self-discipline in your planning and buying. If you are wise with your choices and avoid money mistakes you can win with money and retire with dignity. If you want to keep up appearances you can be normal...and broke. Make your choice. Choose what you want most over what you want now.

What is Our Best Way to Save More Money Each Month?

Quit giving your money away to debt payments. Ultimately the best way to save more money each month is to quit giving it away to debt payments. The best way to build wealth and retire with dignity is to get on a path toward paying off debt. When you give away your hard-earned money to make debt payments you limit your most important wealth-building tool, your income. Learn how to pay off your debt here using a zero-based budget.

None of these tips to save more money each month are necessarily easy. The answers to hard things in life are rarely the easy thing, rather the answers lay in a series of wise decisions over time that yields the results you are looking for. If you want to save more money each month begin with a single wise decision such as the tips we outlined above and keep adding to them. Before you know it your monthly margin will begin to grow and you'll be saving more than ever before.

When it comes to money, shortcuts only leave you with more trouble and headaches. Making your money behave is the best way to save and build the future you want. "Children do what feels good. Adults devise a plan and follow it."

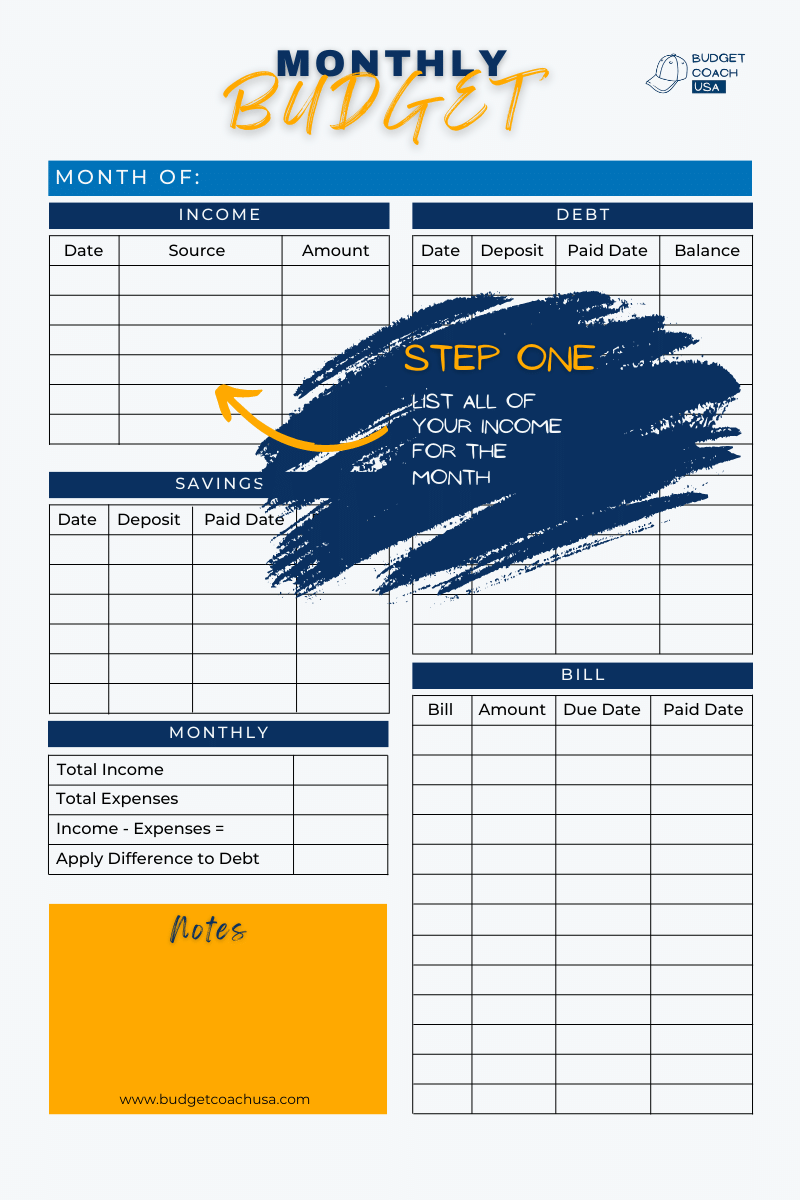

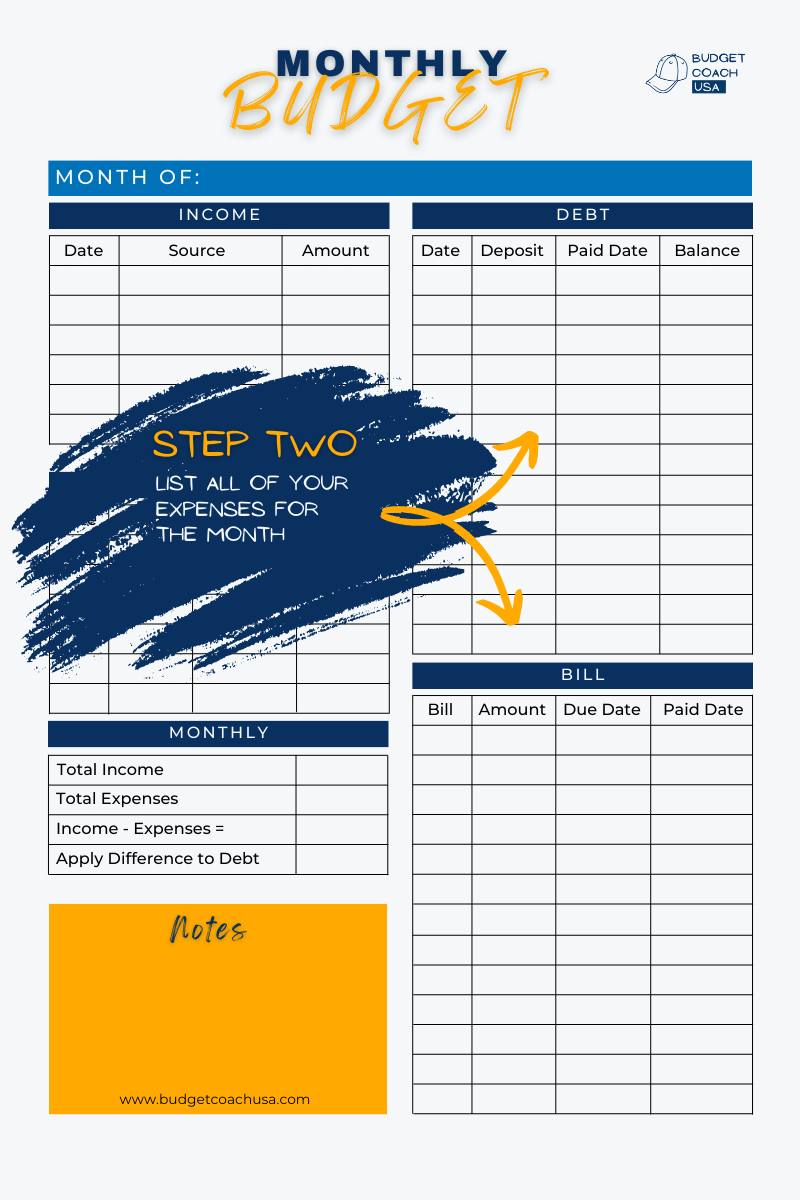

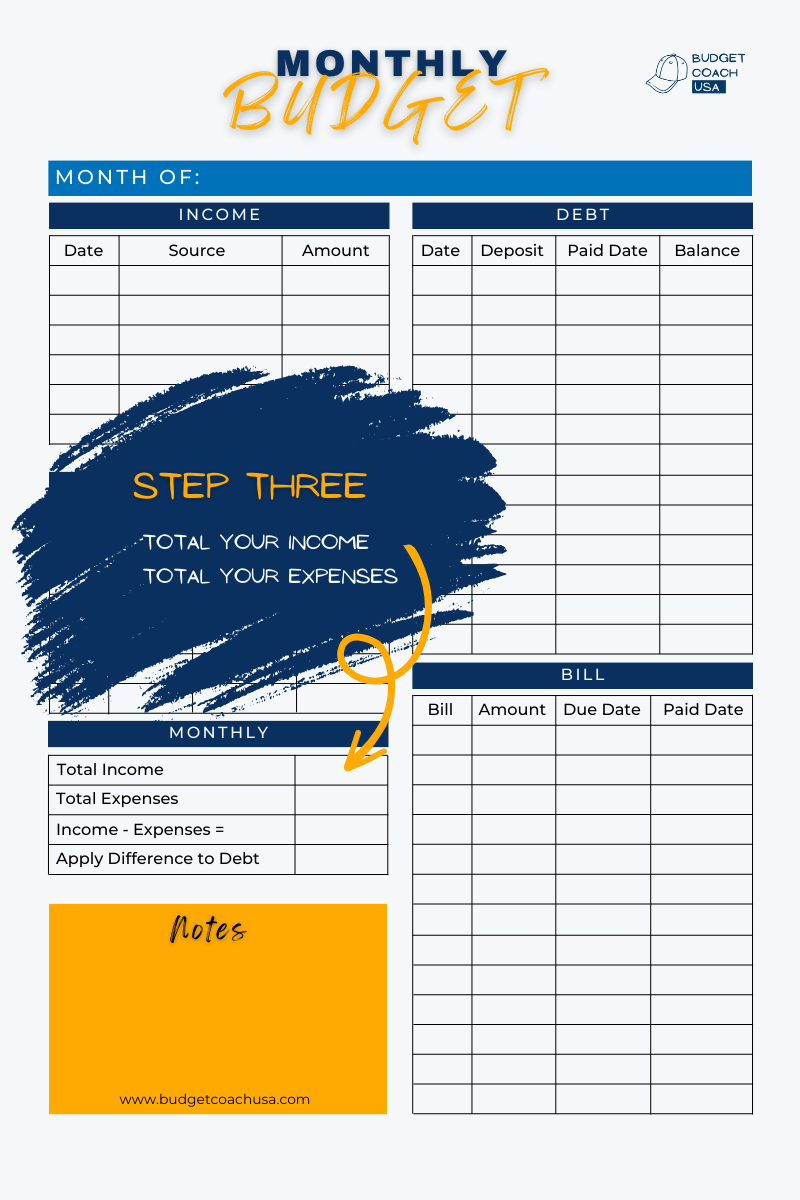

Why not start now and create a budget? Check out the printable template below or request a budget template by emailing scott@budgetcoachusa.com

A caption that describes the image.

A caption that describes the image.

A caption that describes the image.

.png)

.png)

.png)

Budget Coach USA offers personal financial coaching to individuals and couples who are struggling with control over their income and expenses. We help our clients establish family budgets, stick to them and work through common sense strategies for paying off debt and building the future they want for their families. Why not schedule a free consultation today?